- Published on

EURUSD - Trade Execution - 28-09-23

- Authors

- Name

- Tradeaze

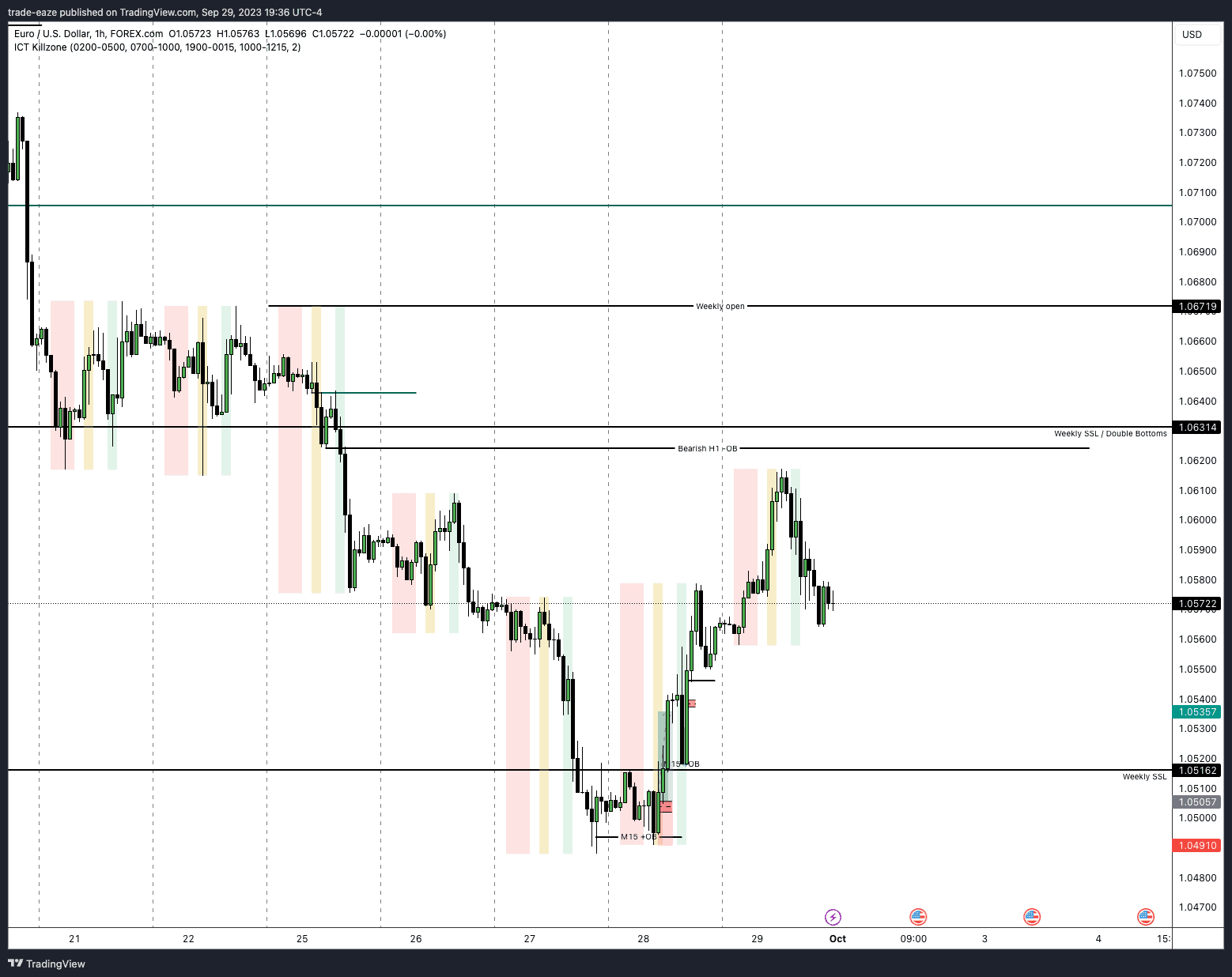

HTF Chart

I anticipated price would move above the weekly open for a continued moved towards the weekly SSL, however, Monday, Tuesday and Wednesday just continued falling. My mind gravitated towards weekly profiles and anticipated a reversal on Thursday for a potential buy.

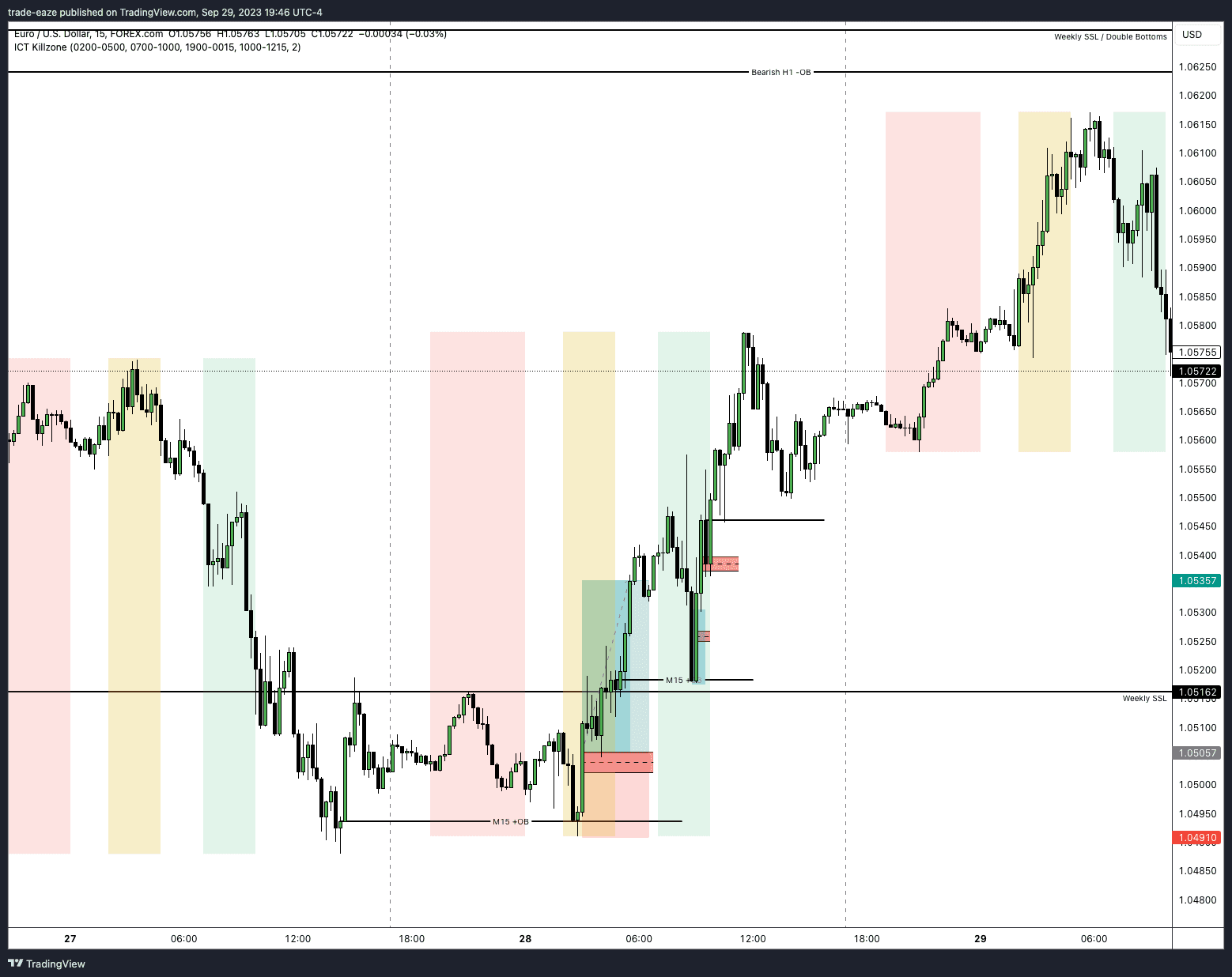

In hindsight, I marked the bullish order block incorrectly but the level worked in terms of what I wanted to see. If that level showed support and quickly moved away from it, I was very interested in looking for longs. The M15 from Wednesday supported price and we saw a quick move away on the M5 chart.

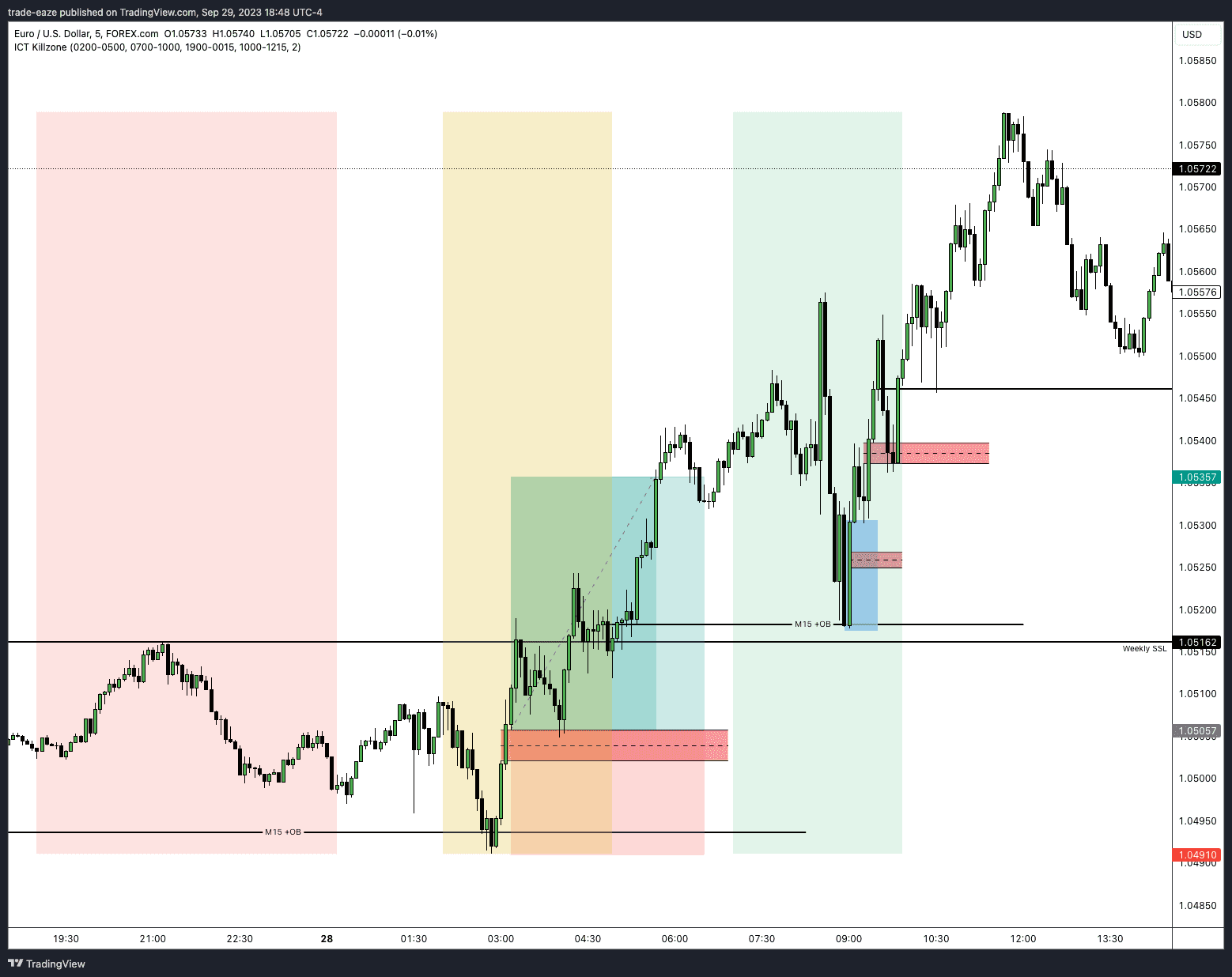

Once I saw the impulse move away and the FVG left behind, I was primed for a long entry on the M5. I did see more opportunities setup and present themselves on the M15/M5 timeframe with bullish order blocks which I could have used to pyramid and enter more positions but I didn't. I was content with the one position and if I'm honest, didn't have the confidence to pull the trigger on the additional two positions, but I was happy to see my analysis playing out.

A good trade, executed with good context around the trade idea. It's month ending, I'm expecting some accumulation, manipulation and then distribution for the next monthly candle. Let's see what the coming weeks bring.