- Published on

EURUSD (FOMC) - Trade Execution - 18-09-23

- Authors

- Name

- Tradeaze

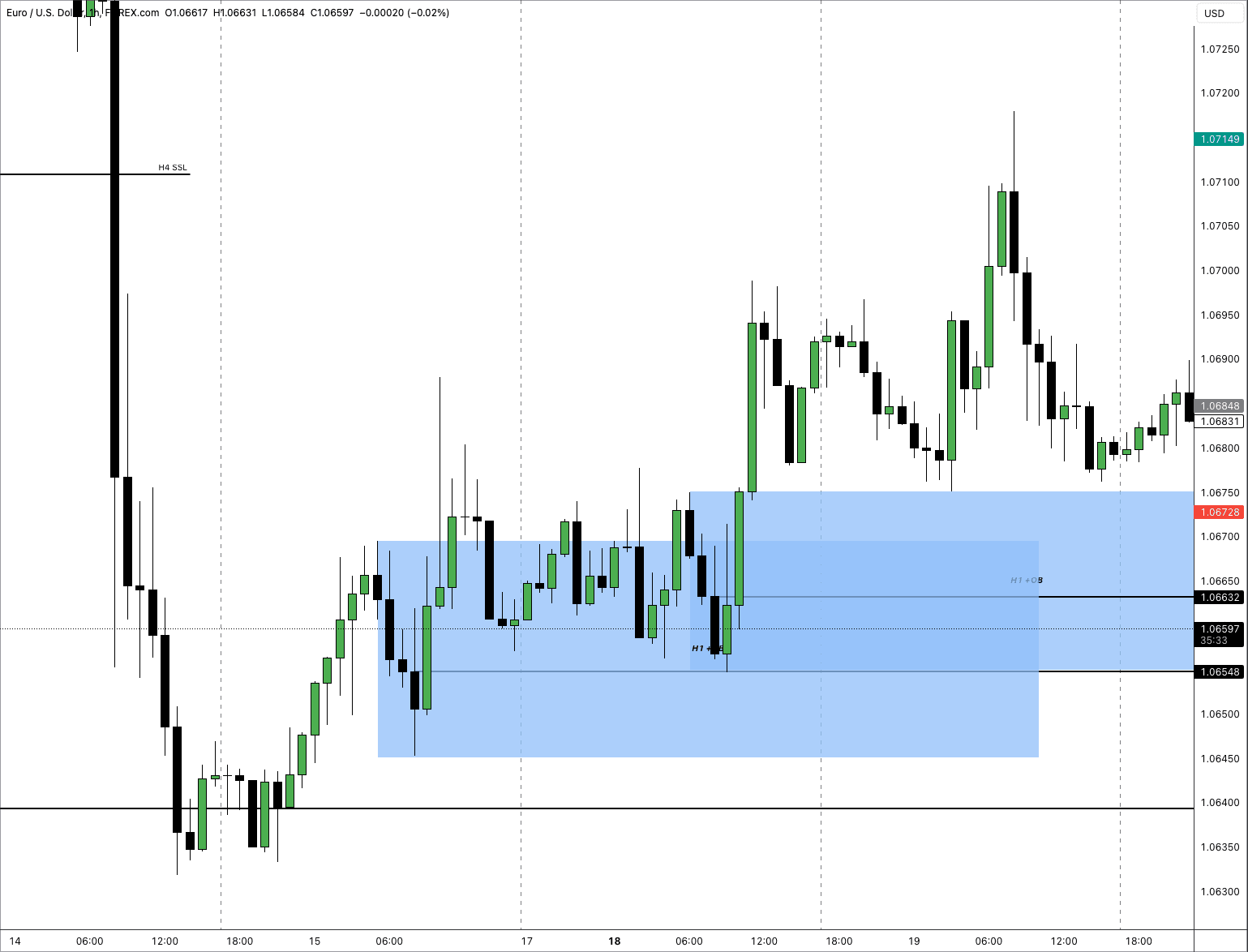

HTF Chart

The price action from Tuesday left behind another H1 bullish order block, this time with an FVG. Should I wait for the candle body close or should I look for my setup on the lower time frame once price enters that area. I waited for price ot hit the top of the order block which coincided with the London session and I began waiting for price to show me my entry criteria.

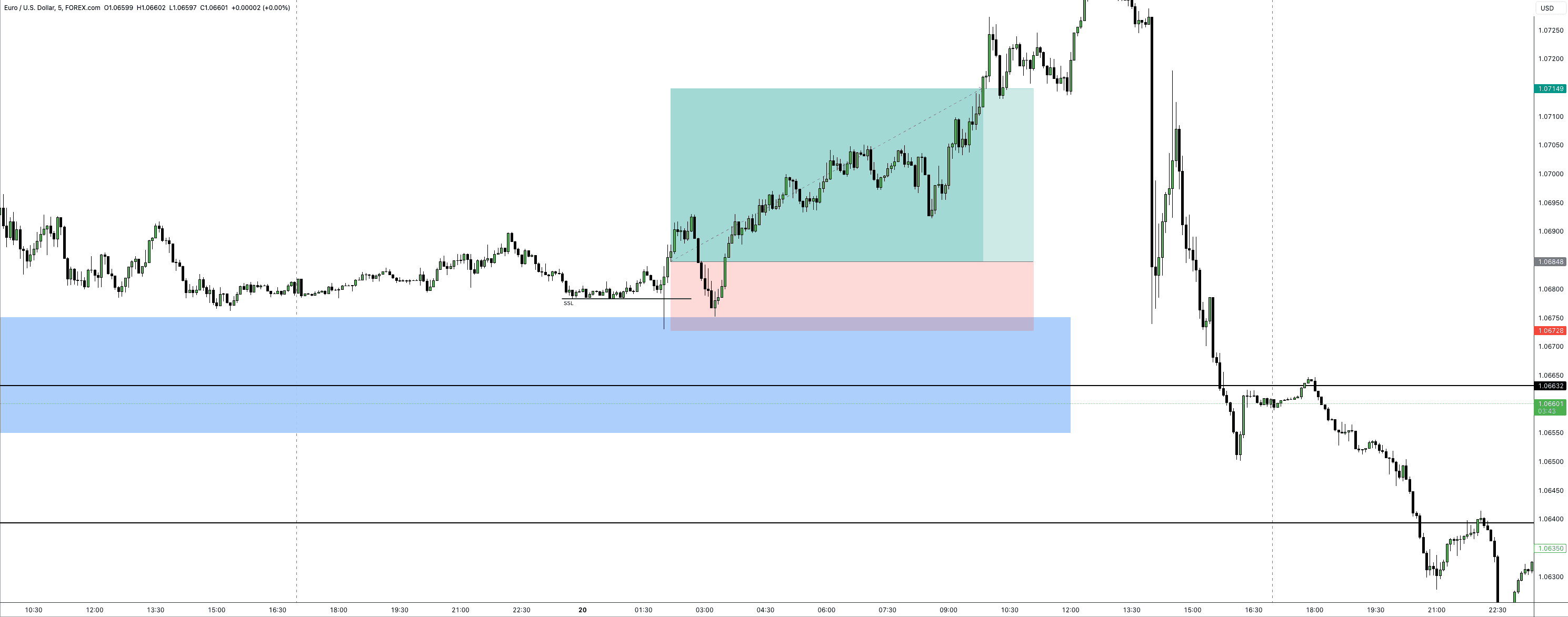

I then dropped into a lower time frame M5 chart.

I noted a double bottom in the H1 bullish order block and waited to see if price would raid that and move higher quickly. It did, so the next thing I looked for was the market structure shift (MSS). Green lights are go, I'm now looking for an FVG to enter my trade on. There are two, I didn't want to miss out on the move and maybe with experience I'll be able to determine, I'm in a deep discount within a deep discount.

So entered a long position, felt nervy watching it drop to the lower FVG, thinking I could have read this completely wrong, but flicking between the H1 and M5 charts, I held my nerve to let price run upwards and when it started moving with some pace, all that was left was to manage the trade. Aiming for about 30 pips, ended up taking a bit more.

A note on the draw-down, it's worth mentioning that it did cause me a little panic but if I recall I saw a SMT divergence with GBPUSD which gave me some confidence in holding on to the position.

I mentioned the H4 liquidity void in my previous post and interestingly enough price had closed the liquidity void at FOMC and then subsequently melted.

I reached my weekly objective in terms of monetary gain and now the challenge is to try and avoid trading the rest of the week (this is where I struggle a lot).